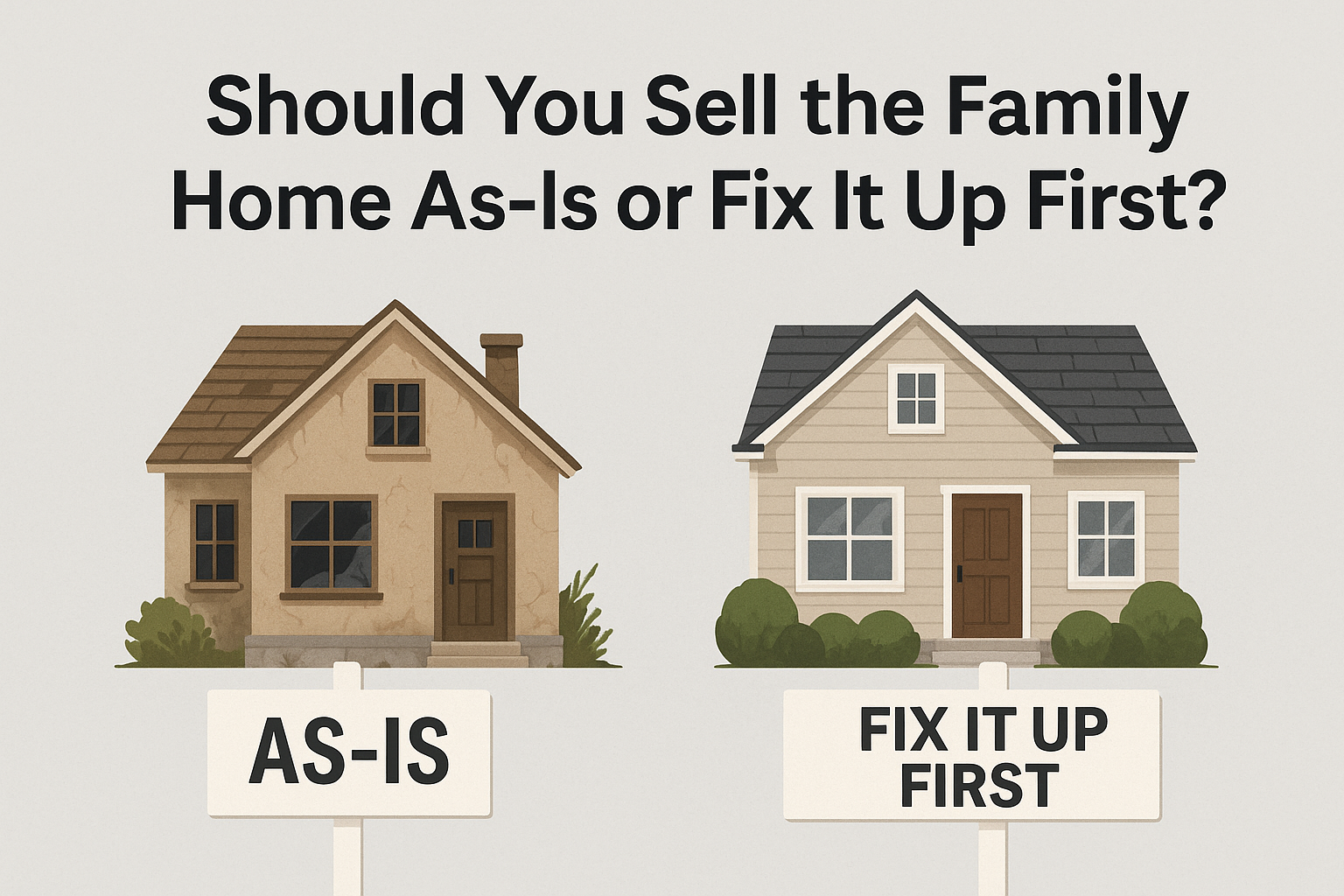

Before You List the Family Home, Weigh the Costs of Selling As-Is vs. Updating

When families prepare to sell a home through probate or trust, one question always comes up: is it smarter to sell the property as-is, or make updates before putting it on the market?

The answer? It depends.

Every home and every situation is different. Keeping beneficiaries aligned during the estate process is another key part of the journey. Together, these steps help families make a decision that aligns with their goals, timeline, and financial reality.

Selling As-Is: Key Pros and Cons for Families

Pros:

Faster timeline: You can typically list and sell more quickly, which is especially helpful if the estate needs to be settled soon.

Lower upfront cost: Selling as-is avoids out-of-pocket expenses for repairs or renovations.

Attracts investors: Some buyers, such as flippers or landlords, are actively looking for homes with renovation potential. This can help the property move faster.

However, selling as-is is not without trade-offs. Before making a final decision, it’s important to weigh the potential drawbacks.

Cons:

Lower sale price: Most as-is homes sell at a discount compared to updated, move-in-ready properties.

Smaller buyer pool: Many buyers prefer homes that need little to no work. As a result, selling as-is often limits your audience to investors and flippers.

Perceived issues: Even minor wear-and-tear can raise red flags. Buyers may overestimate repair costs and lower their offers.

Financing challenges: Some lenders are hesitant to approve mortgages for properties that need significant updates, which can further shrink your buyer pool.

Fixing It Up: When It’s Worth the Effort

Pros:

Higher market value: Strategic improvements—like fresh paint, updated fixtures, or new flooring—can yield a strong return on investment.

Wider buyer appeal: A move-in ready home attracts more competitive offers.

Better presentation: A clean, updated home photographs better and shows well during open houses.

Cons:

Time and coordination: Repairs and staging add time to the timeline and require vendor management.

Upfront costs: Trustees or heirs may need to front the money for updates (though sometimes expenses can be reimbursed from the sale proceeds).

Decision fatigue: With multiple family members involved, agreeing on what to fix and how much to spend can be stressful.

OUR ADVICE

Let the Market Guide You

We always recommend starting with a professional walkthrough and a market analysis. Not every home needs a full remodel to deliver a strong return. In many cases, small steps like removing clutter, deep cleaning, and making simple cosmetic updates can have a big impact.

We also look closely at the local competition. Are buyers in your area paying a premium for updated, move-in-ready homes? Or is inventory low enough that an as-is property will still attract strong interest?

In the end, our goal is to help you find the right balance by maximizing value and minimizing stress for you and your family.

Need Help Deciding?

We specialize in trust, probate, and inherited home sales. Whether your property needs a light refresh or a full transformation, we’ll create a custom strategy that works for your timeline, your budget, and your goals.

Reach out today to schedule a no-obligation consultation.

Leave a Reply